“Say Goodbye To The Goldilocks Investment Landscape”

We are entering a new era of market volatility.

Equity and bond investors need to be prepared as the not-too-hot-not-too-cold ‘Goldilocks’ landscape of 2017 gives way to a more turbulent reflationary scenario – characterized by slightly faster growth and inflation – in 2018.

That Goldilocks scenario came about thanks to a combination of steady growth, low inflation and falling market volatility, which helped drive investor returns. The effect on global asset markets was extremely positive. But change is now afoot, and we believe investors should be prepared for greater uncertainty as the global economic cycle matures.

“The sweet spot in global equity and bond markets is behind us, and generating returns from the market will become trickier.”

Equity market volatility, as measured by the S&P500 VIX index, is likely to trade in a volatile range of 15-20 in 2018, far higher than the low of 9.1 back in November last year.

Meanwhile, inflation, as measured by the US core consumer price index, has also passed the low for this cycle. It’s currently 2.1 per cent, up from 1.7 per cent in August 2017. As inflation rises, so do bond yields, although we believe that structural factors, including demographics and job insecurity, are likely to limit the upside on both.

The combination of moderately higher bond yields and increased volatility has significant implications for investors as it implies that the sweet spot in global equity and bond markets is behind us, and generating returns from the market will become trickier.

The Case For Equities

Despite the market uncertainty, equities are still our preferred asset class, and we believe investors should have an above-benchmark allocation. Asia ex-Japan is our preferred market, reflecting a combination of factors, including strong earnings growth expectations for 2018 and attractive valuations at 13 times the 2018 consensus earnings forecast.

Within Asia ex-Japan, China is our preferred market because strong earnings growth and financial de-leveraging is reducing risks in the financial sector. In addition, investor flows are rising from Shanghai to Hong Kong, as mainland China investors warm up to Hong Kong-listed equities, especially in the technology and financial sectors. The flows through the Hong Kong-Shanghai Stock Connect system now account for 15 per cent of turnover in the Hong Kong stock market (Hang Seng Index), up from 10 per cent last year.

“While we are likely headed for more turbulent times, we do not believe that investors should feel nervous.”–Clive McDonnell

Asia will benefit from a weaker US dollar

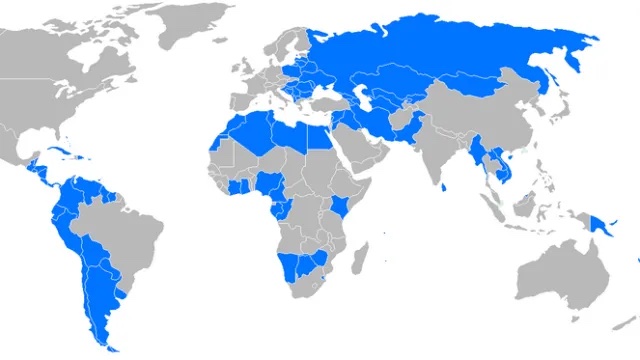

We expect the US dollar to weaken further, albeit moderately; a shift that is likely to be positive for Asia ex-Japan and other emerging markets. This is because, as the US dollar weakens and Asian currencies strengthen, regional central banks release local currency to buy US dollars in order to hold down the value of their local currencies. While some of the increase in local currency supply can be absorbed via issuing bonds, it generally has the effect of increasing domestic liquidity and holding interest rates lower than would otherwise be the case. We expect higher liquidity and lower interest rates to drive equities and other local asset prices higher.

Bonds Still Relevant

Fixed-income investors also need to adapt to the new era of higher inflation and volatility, as it is likely to undermine returns from developed market government bonds. We continue to view bonds as core to investors’ holdings, preferring emerging market US dollar and local currency bonds.

These bonds include a wide-yield premium over US treasuries that offer a cushion in a rising yield environment. The recovery in commodity prices is also an important driver of emerging market (EM) US dollar bonds, while a weaker US dollar is positive for EM local currency bonds.

The ‘just right’ investment scenario looks like it’s behind us. But while we are likely headed for more turbulent times, we do not believe that investors should feel nervous, as the kind of valuations we’re seeing suggest global equities and emerging market bonds still have the potential to deliver positive returns.

About Clive McDonnell

Clive McDonnell is a Singapore-based strategist with Standard Chartered focused primarily on equity markets, bringing two decades of experience in the field of equity strategy. He joined firm in 2011, having previously worked in Asia for French investment houses BNP Paribas and Société Générale, Prior to this he was based in London with Standard and Poor’s (now SP Global). He is a graduate of the National University of Ireland, Galway, and holds an honors degree in Economics and English.