In 2008, Islamic banking accounted for 7.1 per cent of Malaysia’s financial sector. By 2016, that figure had leapt to 28 per cent, and the Malaysian government hopes to push it over 40 per cent by 2020.

While almost every Islamic banking practitioner has followed the growth of Islamic banking in Malaysia in recent years, my move to Malaysia five months ago with Standard Chartered has given me the opportunity to experience that growth first hand.

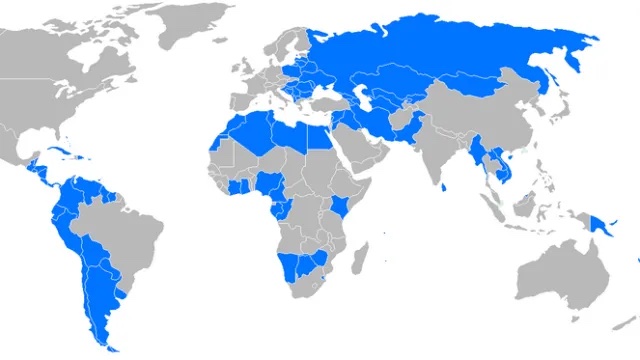

Countries around the world are at different stages of evolution when it comes to embracing Islamic finance. Malaysia’s Islamic finance sector has been going from strength to strength, spurred primarily by the following five factors.

Products Must Be Inclusive

If you go to a fast food restaurant which displays the ‘halal’ sticker at its entrance, it does not mean that the restaurant serves food to Muslims only. The approach of Islamic banks in Malaysia is similar: products are developed for the entire market, regardless of the consumers’ religious beliefs.

An example of this is ‘takaful’ (insurance) products, where the benefits of ‘hibah’ (gift) and the principle of ‘surplus sharing’ are attractive to all. This is how it works in favoor of all clients: ‘hibah’ allows clients to nominate any individual to be the beneficiary of a ‘takaful’ plan, while surplus sharing means the profit earned is shared with clients as they are deemed to be participants in the business. In this way, Islamic banking products are no less competitive than conventional; in fact, surplus sharing means they may be even be more so.

Standardization Will Bring Consistency

Malaysia’s central bank, Bank Negara Malaysia, has rolled out a plan to standardize Shariah contracts over the next two years. It will impact almost all retail, business banking and corporate products. While this entails detailed gap analyses, documentation changes, system modifications, and more, the result should be a robust governance environment offering products that adhere to the highest Shariah standards.

Regulatory Support Has Brought Consistency

Not only has Malaysia’s central bank developed a roadmap for Islamic banking growth; it also works closely with banks to facilitate this journey.

It began in the 1980s when the first Islamic bank was established under the Islamic Banking Act 1983. Following this, Shariah compliance regulations were issued to ensure conventional banks carried out Islamic banking in accordance with Shariah guidelines. The central bank regularly engages with industry experts, ensuring an open dialogue, which is crucial for positive change.

In 1997, the ‘Shariah Advisory Council’ was established as a way of harmonizing the views among Islamic financial institutions. In addition, a dedicated ‘Muamalat court’ was set up to lead the industry towards greater efficiency in managing Islamic finance cases, strengthening accountability and building a contract-based regulatory framework.

“Not only has Malaysia’s central bank developed a roadmap for Islamic banking growth; it also works closely with banks to facilitate this journey.”==Ali Allawala

Industry Engagement Grows The Sector

The Association of Islamic Banks in Malaysia has proven to be an effective forum for promoting Islamic banking. Its members include heads of Islamic banks with the objective of promoting the industry in consultation with the central bank and other regulatory bodies. The body meets to discuss new ideas and issues facing the industry. In the meetings I have attended, it was heartening to see that attending CEOs were thinking beyond their respective organizations, with the common objective to grow the industry.

Sustainable Banking Brings Sustainable Benefits

Value-based intermediation is the next direction for Islamic banking in Malaysia. The concept is that Islamic banking transactions should not just be Shariah compliant, but also contribute positively and sustainably to the economy, community and environment, without compromising the financial returns to shareholders.

It is similar in principle to, for example, concepts such as environmental, social and corporate governance: a more holistic approach that ensures Islamic banking products and services not only comply with Shariah law, but also achieve the intended outcomes of Shariah.

Photo: Bank Islam Malaysia