March marks the end of nine years of the equity bull market that started in the aftermath of the global financial crisis. The US S&P 500 stock index has quadrupled in that time, while the MSCI All Country World index has tripled over the same period. While it’s tough to repeat this sterling performance year after year – as the equity market correction in February and the return of volatility highlighted so vividly – the broader macroeconomic outlook suggests that the next 12 months are likely to be another constructive year for investors.

The pick-up in global growth, which resulted in strong corporate earnings and rising equity valuations last year, is likely to continue over the coming months, driving stock market performance. Meanwhile, a gradual revival of inflation in the US, euro area and Japan reduces the risk of excessive monetary policy tightening, supporting bonds.

A valid question we get from investors is: how much longer can this bull market last? After a nine-year economic recovery, we are clearly at a fairly late stage in the business cycle. However, history teaches us that equities tend to see some of the strongest gains in the final stages of the business cycle. This lesson is one reason why we prefer equities over bonds.

“One of the key assumptions driving our positive view on emerging market assets is that the US dollar is likely to continue weakening modestly in 2018”–Steve Brice

Equities To Outperform Bonds

Our preference for equities is because the outlook for global earnings growth remains reasonably strong, driven in many regions by expansion in profit margins. This offers grounds for further equity market gains, beyond just higher valuations. Although valuations are undoubtedly above long-term averages in most regions, they are not too stretched. Historically, equity markets have, on average, delivered positive returns from similar valuation levels.

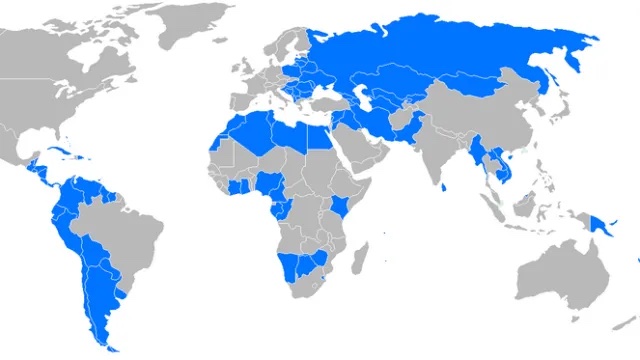

Asia ex-Japan is our preferred equity market, supported by both profit margin expansion and valuations that remain inexpensive relative to developed markets. We also believe emerging markets outside Asia warrant more attention – their economies’ relatively tight correlation with commodity prices has been a key source of support for them over the past year. Meanwhile, the US has led a surge in corporate earnings revisions following the tax cuts late last year, cementing the market’s status as a core holding.

Opportunities Within Emerging Market Bonds

Among bonds, we prefer emerging market debt as we believe it offers an attractive balance between yield and quality. Emerging market (EM) US dollar government bonds offer a reasonably attractive yield (c.5 per cent) sourced from a mix of both investment grade and high-yield government debt.

While emerging market bonds are sensitive to rising US Treasury yields, a modest rise in inflation means the benchmark 10-year Treasury yield is unlikely to rise significantly above 3 per cent. Add to that the relatively higher yield buffer offered by the EM US dollar government bonds, and this makes them an attractive source of regular income.

One of the key assumptions driving our positive view on emerging market assets is that the US dollar is likely to continue weakening modestly in 2018, which will encourage continued capital flows into emerging markets. We believe the European Central Bank (ECB) has a greater chance of surprising the market by withdrawing its asset-buying program sooner than the current expectation, which is September. In contrast, further US Federal Reserve rate hikes are unlikely to dramatically surprise the market.

Against this backdrop, we expect the euro to extend gains, especially if the ECB remains on the path of gradually removing monetary policy accommodation. A softer US dollar is likely to be positive for emerging market currencies, creating an opportunity to add exposure to emerging market local currency bonds.

“There is value in favoring equities, while also starting to think about alternative strategies that have lower drawdown risks”

Manage Downside Risks With Alternatives

While we remain constructive on the global economic backdrop, it is extremely difficult to time the end of the business cycle. The fact that US equities and high-yield bond markets have historically peaked six-to-nine months ahead of a US recession makes the investment decision even harder. Inflation is the main risk to the ‘reflationary’ scenario, especially further into 2018. A larger-than-expected rise in inflation would mean the environment could turn too hot, forcing central banks to tighten policy sooner than expected.

Given the risks, we believe there is value in favoring equities, while also starting to think about managing downside risks by allocating to alternative strategies – such as equity long-short strategies, which benefit from both rising and falling equity markets – that have lower drawdown risks and less correlation with traditional asset classes.

About Steve Brice

Steve Brice is the Chief Investment Strategist with Standard Chartered. Based in Singapore, he is a known expert on the world economy and global markets. He has over fifteen years’ financial markets experience in senior positions. He was previously Head of Global Markets (Southern Africa), Head of Research (Middle East and South Asia) and Chief Economist (SE Asia) with Standard Chartered. He began his career at I.D.E.A. Ltd., a financial consultancy in London. Based in Singapore, he travels frequently around Asia and the Middle East to share his views with both clients and the media. Originally from the UK, he has lived in Asia, Africa and the Middle East for the past 15 years. He holds a Masters from the University of Liverpool.

Photo Credit: Inbound Logistics