A report published by Moody’s Investor Service this month details the impact of credit exposure on frontier markets. According to the agency, frontier markets will show “differentiated credit exposure” as interest rates rise globally, similar to the shock these economies experienced when commodities began to bottom out 2014-2015.

Adding to this, the current debt level of frontier market sovereigns are expected to remain “elevated” and spending on more debt servicing is expected over the next year.

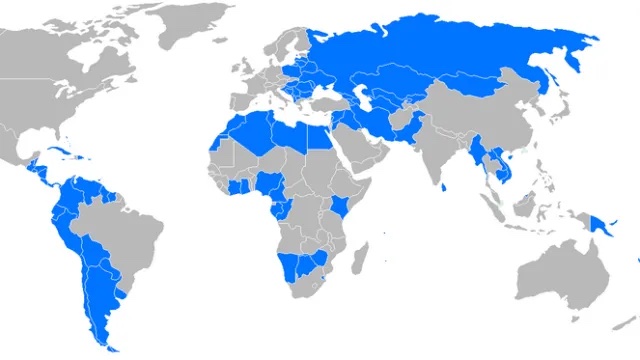

“Benign global liquidity conditions have permitted some frontier market to raise commercial USD sovereign debt, at relatively favorable rates,” says Anne Van Praagh, a managing director with Moody’s said. “One quarter of frontier markets had issued new debt on commercial terms as of August 2017. Meanwhile, some frontier markets are relying on finance and investment from China and less on multilateral concessional debt.”

Looking ahead, she adds, as global liquidity conditions are expected to evolve, with elevated debt service costs and liquidity risks being the key credit challenges for frontier markets. “The ability of individual frontier markets to handle rising interest rates and

rollover of commercial debt is differentiated.

“Vulnerabilities are highest for those countries where high leverage combines with a constrained ability by domestic policymakers to ease monetary policy and preserve fiscal flexibility.”

Looking at particular economies, vulnerabilities to rising global interest rates are highest in Mongolia, Mozambique and Egypt. These sovereigns in particular, according to Van Praagh, have shown limited available fiscal and monetary space–

and buffers vary across frontier market economies.

In contrast, Bangladesh, Nigeria and Vietnam are better positioned to withstand higher interest rates, says Moody’s.

The agency also points to the strength of institutions as a factor in determining a sovereign’s ability to counter negative shocks, such as a rise in global capital costs. In many frontier markets, weak institutions constrain their ability to buffer

against shocks.

In addition, direct external vulnerability risks are high for around 25% of frontier market sovereigns that Moody’s Investor Service rates. Reliance on foreign capital to fund current account deficits also heightens the vulnerability of these sovereigns to capital outflows or lower inflows that can exacerbate difficulties in meeting current account and external debt payment obligations.

The agency currently rates 36 frontier market countries, most of which carry ratings in the B1-B3 range. Of the 36, downgrades have outnumbered upgrades and none have climbed to investment grade since their sovereign rating was initiated.

Photo Credit: Streets of Dhaka, Bangladesh via Getty Images