Before the emergence of oil and gas, there was coal. Cheap and plentiful coal powered the Industrial Revolution in Europe and the United States.

In recent years, coal consumption in those regions has declined, largely because of competition from natural gas, which also has fewer harmful emissions.

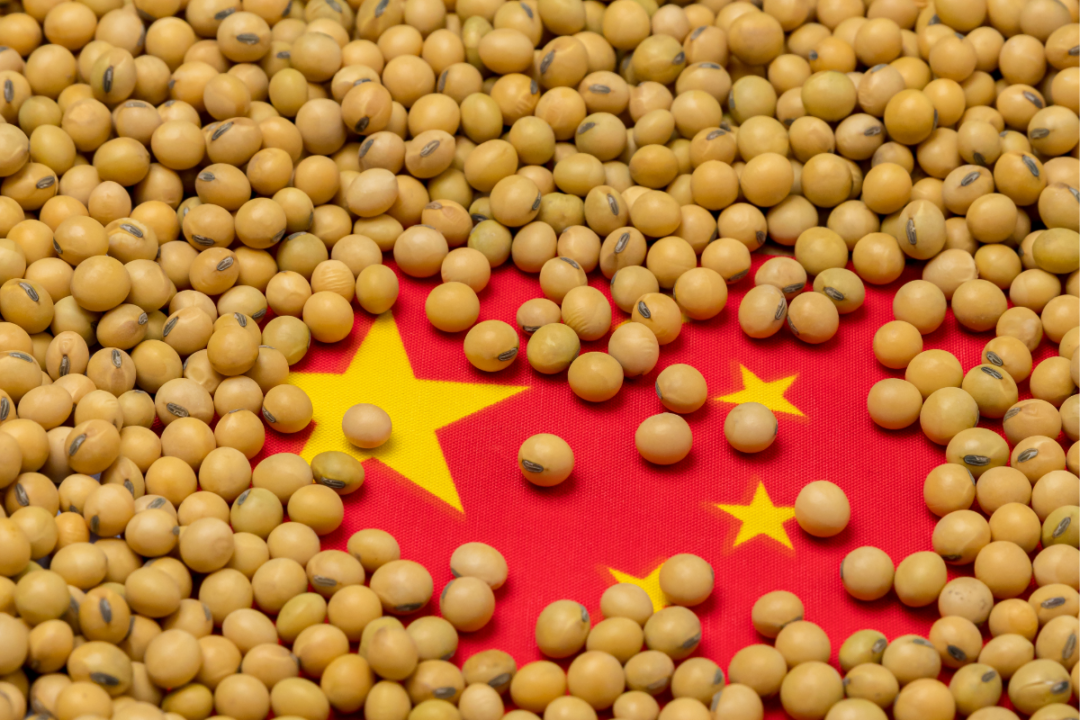

But demand for coal remains very strong in other parts of the world, particularly from the growing economies of Asia, which are adding more and more electricity production every year to power their industrialization strategies.

Coal producers and exporters around the world now look to meet demand in India, China and Japan. And while Indonesia and Australia are the dominant suppliers in the region, coal reaches Asia from as far afield as South Africa, Colombia and Russia.

The diversity of buyers and sellers in the Asian coal market is making the region a significant location for price discovery. And as the markets for physical coal in Asia continue to grow, there is also an upturn in demand for risk management.

Market Liberalization Brings Hedging

Power generators, coal miners and traders use coal derivatives to protect themselves from price movements that may impact on their profitability.

The most sophisticated region is Europe, where the electricity markets are liberalized. European power companies typically trade coal as a spread to electricity (the “dark spread”) as well as a spread to natural gas and to European emissions certificates.

Asia has traditionally lagged Europe in terms of managing coal price risk. Few Asian electricity companies operated in a competitive environment. They were typically able to pass any increase in higher fuel costs to the consumer, reducing their need for risk management.

Demand for coal is on the rise across China, India and Japan.

This is gradually changing. Some Asian countries such as Japan have introduced measures to liberalize the power sector. Other electricity producers, like those in China, are motivated to use hedging to reduce their fuel bills to keep their industrial sector competitive.

Asia Fired Up

The coal market traditionally used price benchmarks set in the import market in northwest Europe or at export locations in South Africa and Australia. But as the importance of Asia grows, new benchmarks are emerging.

CME launched Indonesian coal futures late in 2018 based on the benchmark provided by Argus/Coalindo for exports of Indonesian sub-bituminous coal. The contract has already traded nearly 2 million tons since launch and open interest is growing.

Indonesian coal futures are still in their infancy but regional-based benchmarks like it could spell the future for coal markets. These markets are experiencing a dramatic shift in trade patterns as Asian demand grows while the northern hemisphere slows.

Owain Johnson is a London-based Managing Director of Energy Research and Product Development with CME Group. This piece was first published by CME Group’s digital publication, Open Markets.